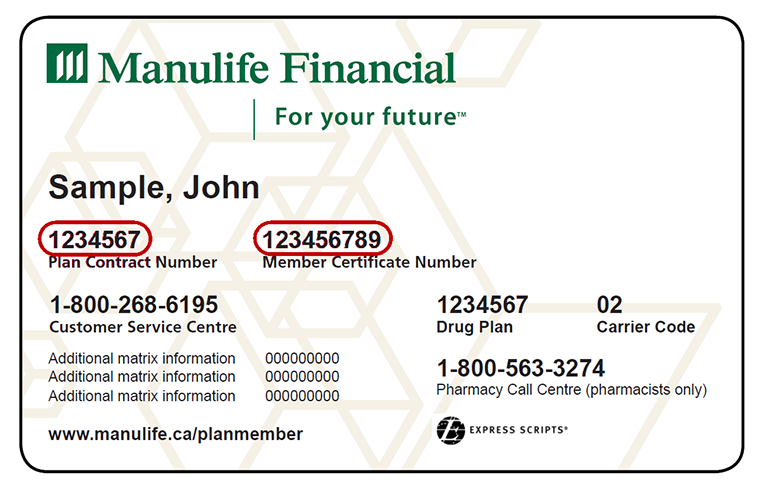

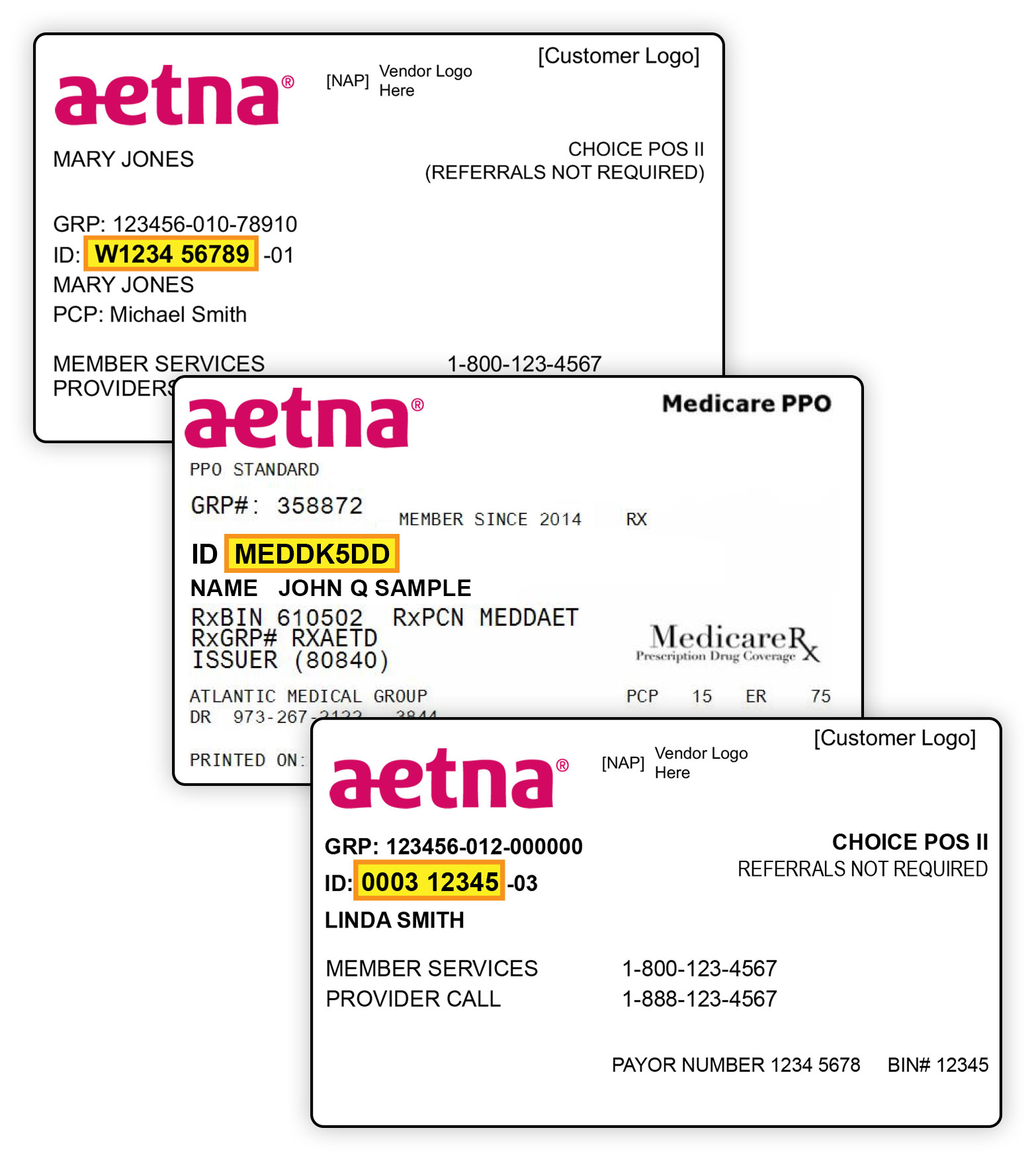

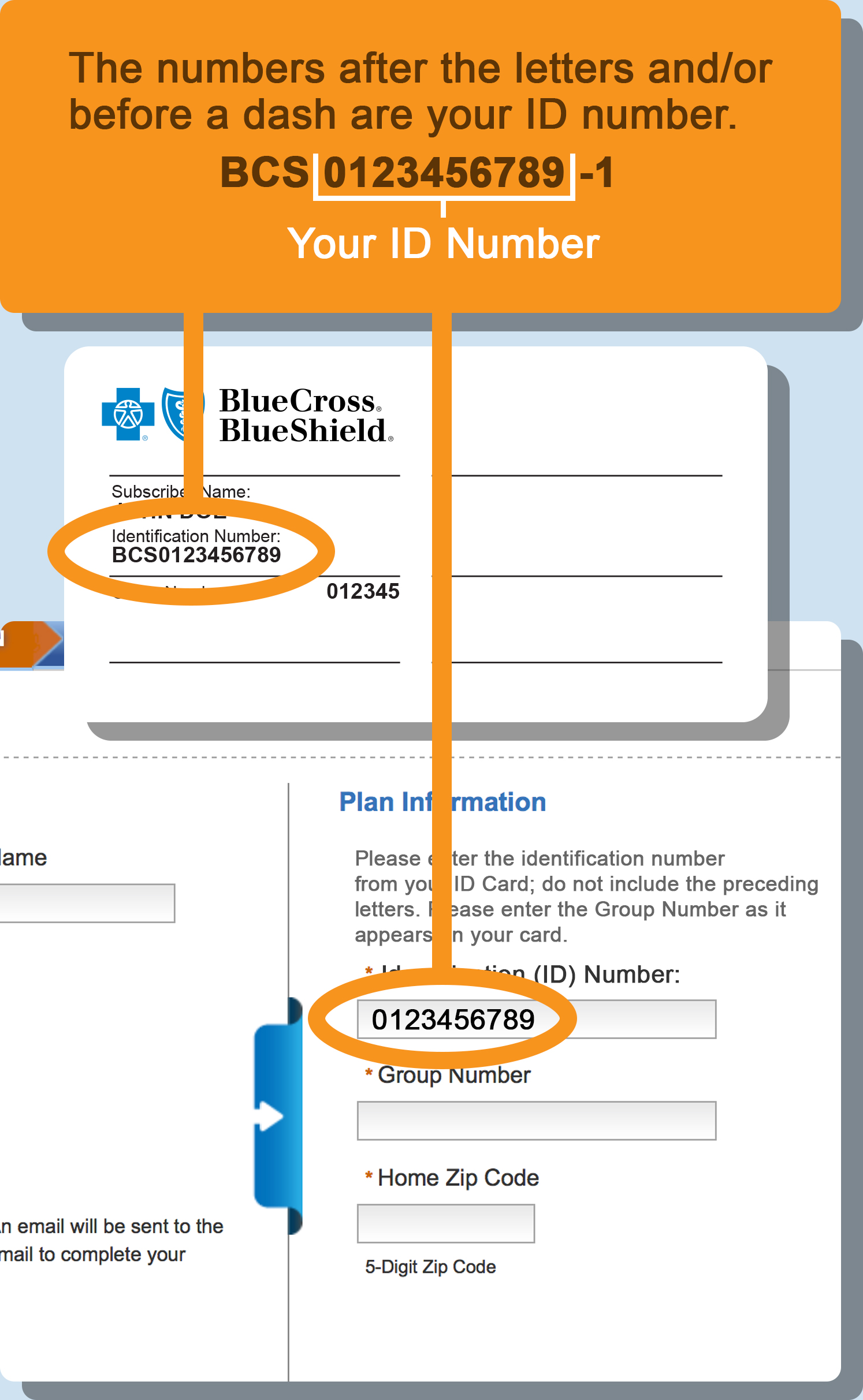

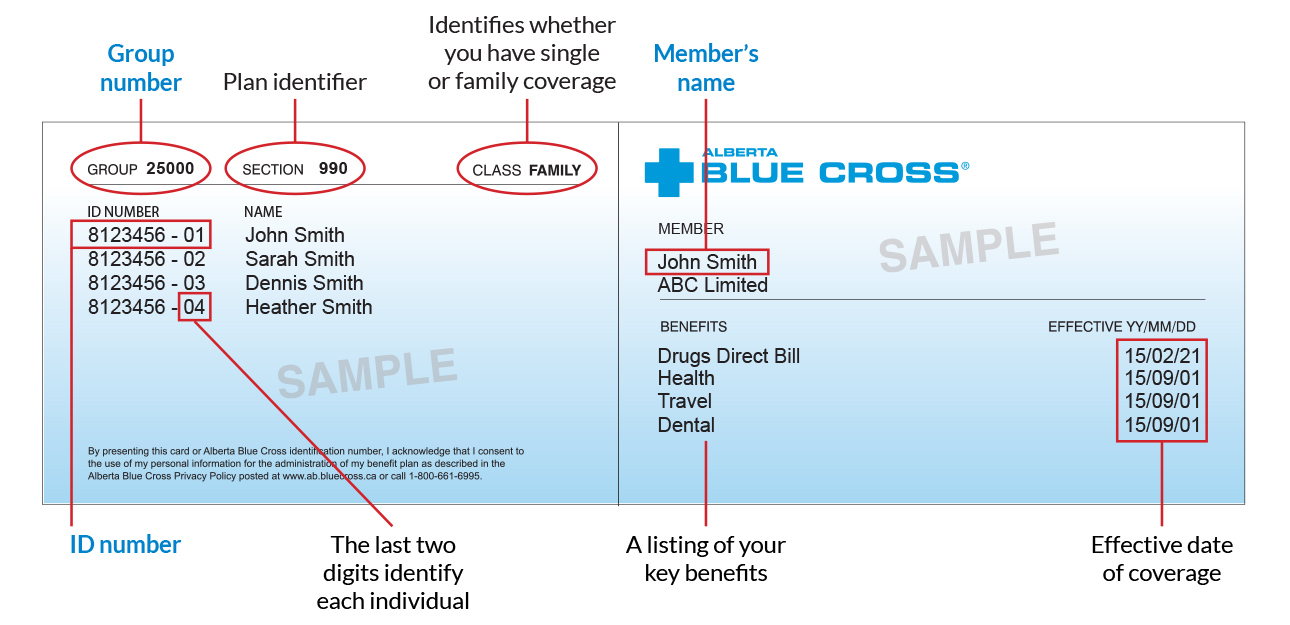

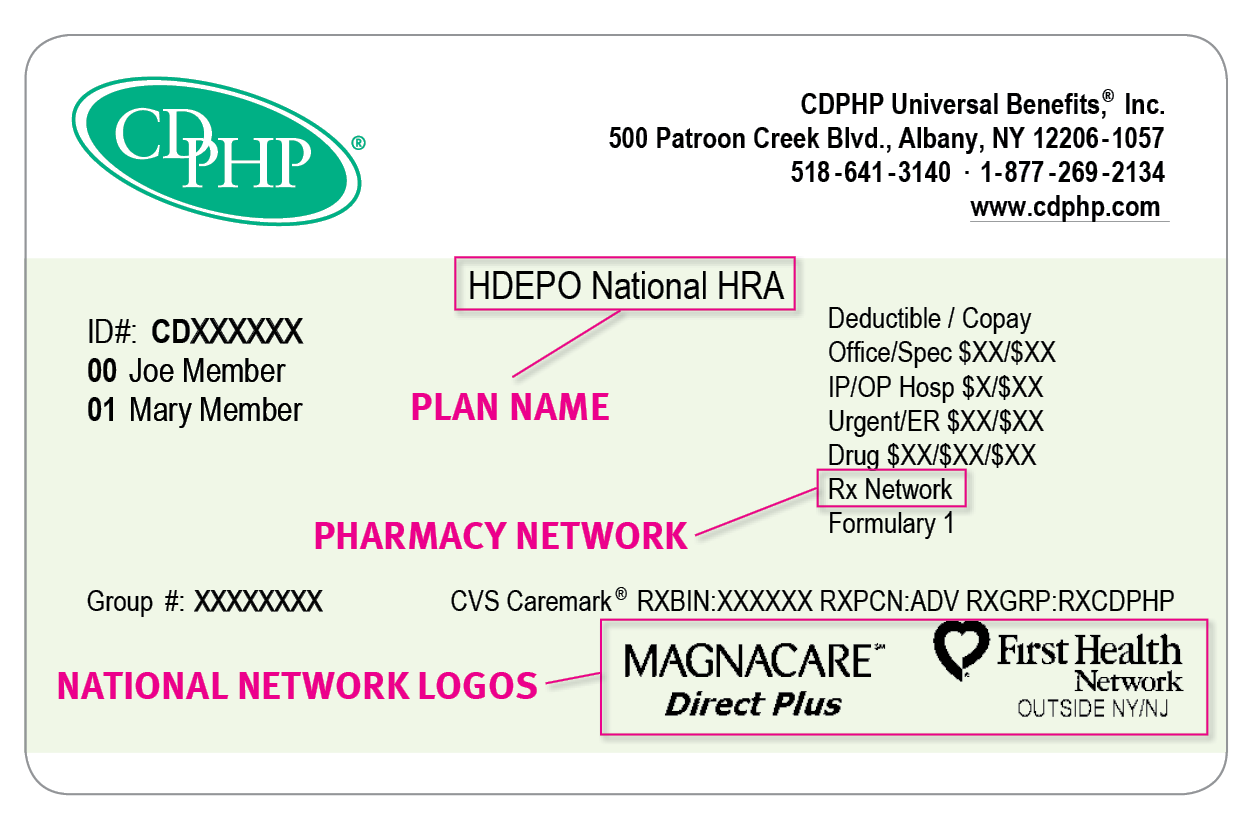

Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department. If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services.

It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. Yes, a benefit year deductible applies for most medical services accessed outside the student health center . Visit theMy Coverage pageto check your plan's annual deductible.

This deductible does not apply to services with fees at an SHC, to emergency or urgent care clinic visits for students, or to pharmacy claims. For some UC SHIP campuses, the benefit year deductible does not apply to UC Family services. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine.

Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network.

A doctor, hospital, or other health care entity that is not part of an insurance plan's network. For medical services rendered by non-participating provider, the patient may be responsible for payment in full or higher costs. Under M+C plans, patients receive medical services without additional out-of-pocket costs. An insurance plan that has contracts with health care providers for discounted charges.

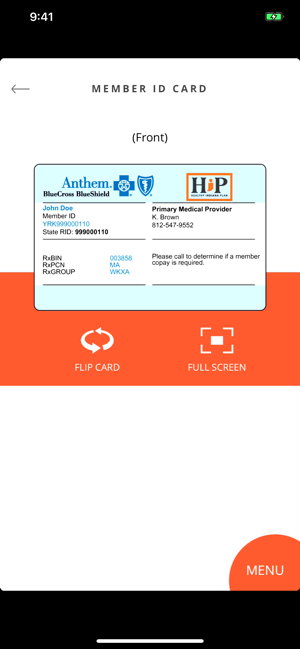

Typically, the plan offers significantly better benefits and lower costs to the patients for services received from preferred providers. Anthem, Inc. is one of the largest health benefits companies in the United States. Because of its large network of providers, giving you many choices for where you get medical services.

Anthem has a variety of health insurance plans available including options for individuals, families, Medicare, Medicaid and group insurance. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers.

In 2004, WellPoint Health Networks Inc and Anthem, Inc. merged and became the nation's leading health benefits company. In December 2014 WellPoint Inc. changed its corporate name to Anthem, Inc. Anthem has about 40 million members and is ranked 33rd on the Fortune 500. Each UC SHIP campus has its own out-of-pocket limits , depending on where you access care.

Visit the My Coverage page to review your campus's benefits. Medical and pharmacy copayments, as well as coinsurance and the deductible, apply toward the out-of-pocket maximum. You will pay a lower out-of-pocket maximum if you receive care from the SHC and network providers. You will pay a higher out-of-pocket maximum if you visit out-of-network providers.

UC SHIP provides 100% coverage of allowed charges for emergency room services after a copayment, and 100% coverage of urgent care center allowed charges after a specified copayment. If Anthem determines that the reason for the visit was not an emergency, the coverage of the charges will be reduced. The annual deductible does not apply to emergency room or urgent care center visits. If you are admitted to the hospital, UC SHIP will cover a percentage of inpatient charges, and the emergency room copayment will be waived. Visit theMy Coverage page to view the benefit levels, copayments and coinsurance for your campus. All follow-up care must be authorized in advance by the SHC.

What Is The Group Number On Anthem Insurance Card If you need a service not offered at the SHC, your clinician will refer you to an off-campus health care provider. The SHC will provide you with a referral to see the off-campus provider. This is not a guarantee of payment, and your deductible, copay and coinsurance will apply. Your SHC clinician may suggest a specific provider, or you can choose a provider. However, we strongly recommend that UC SHIP members see providers who belong to the Anthem Blue Cross Prudent Buyer PPO network, including UC Family providers.

Doing so ensures UC SHIP members will pay the lowest out-of-pocket costs. Policy Number - a number that the insurance company assigns the patient to identify the contract for coverage. A doctor, hospital, or other health care entity that is part of an insurance plan's network. They agree to accept insurance payment for covered medical services as payment in full, less any patient liability. Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card.

This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip. A private insurance plan that accepts people with Medicare.They may go to any Medicare-approved doctor or hospital that accepts the plan's payment. The insurance plan, rather than the Medicare program, decides how much it will pay and what the beneficiary will pay for the services they get. The beneficiary may pay more for Medicare-covered benefits. They may have extra benefits the Original Medicare Plan does not cover. An alternative to the Original Medicare Plan which replaces the Original Medicare Plan and often named as Senior plans following the name of the insurance.

A group of doctors, hospitals, and other health care providers that have a contract with an insurance plan to provide services to its patients. MDLIVE® Behavioral Health Services - MDLIVE®'s caring counselors and psychiatrists are always ready to listen. MDLIVE® Behavioral Health provides affordable, confidential virtual treatment for a variety of behavioral health needs such as depression, anxiety, trauma and loss, substance use and more. In most cases, Behavioral Health consultation fees are the same as your physician office visit. Payment will be collected at the time of your consultation.

For your convenience, MDLIVE® will accept debit cards and most major credit cards. The health care network specified by your Anthem insurance policy will determine whether you have access to in-network providers in other states. When submitting an out-of-state claim, you must contact Anthem's customer service department because the process may be different. You need your ID card anytime you visit the student health center on campus or go to a doctor's office, urgent care clinic, hospital, pharmacy, etc. If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card. If you have an HMO, your card may also list the physician or group you've selected for primary care.

Determining whether a provider is in-network is an important part of choosing a primary care physician. Show your ID card every time you visit the doctor, pharmacy, hospital, or any other healthcare provider. Healthcare providers can use your member ID number to review your benefits, and can let you know if you owe any copayments at the time of your visit. After going through, one can get a pretty straightforward idea about the health insurance cards. I think that it is a good idea to maintain an effective health insurance coverage. I think that the cards should also link the patient's previous medical history.

If you visit an SHC at another campus, you may need to pay out of pocket and be reimbursed for any services you receive. Please check with the SHC you plan to visit for more information about fees and filing claims to UC SHIP. Beginning in 2013, Anthem Blue Cross became the behavioral health provider for Anthem HMO and PPO plans. If you are enrolled in one of these Anthem plans, you do not need a referral from your primary care physician in order to receive mental health services. Visit Anthem's website at /ca for a list of behavioral health providers.

Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card. But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. You might see another list with 2 different percent amounts. The "coverage amount" tells you how much of your treatment costs the insurance company will pay.

This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. If you have health insurance through work, your insurance card probably has a group plan number.

The insurance company uses this number to identify your employer's health insurance policy. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. Groups with the BlueStagesSM will see the plan name Blue Cross Group Medicare SupplementSM on their member ID cards for 2020. This Medicare supplement insurance plan helps members cover some costs not covered by Original Medicare, such as copayments and deductibles. Members can see providers nationwide who accept Medicare Assignment and are willing to bill BCBSTX.

The descriptions below apply to most private health insurance ID cards in the United States. If you live outside the U.S. or have government-provided insurance, you may see some different fields on your card. If you use a network doctor or hospital, your claims will be submitted by that provider. If you see an out-of-network provider, you need to submit the claim yourself. You must submit a completed claim form or alternative documentation via fax or mailing address. As an alternative to sending a claim form, supply a description of services, a bill of charges from the provider and any medical documents you received from your provider.

Anthem has a complex business structure of subsidiaries, and it's not always easy to decipher Anthem versus Blue Cross Blue Shield. The names of Anthem health insurance plans can change based on what state you're in, and some Anthem subsidiaries don't have Anthem in their name. Common examples include HMO Colorado, Empire plans in New York and Compcare plans in Wisconsin. If possible, try to see the same doctor or nurse practitioner for each visit. Knowing your clinician makes visits more comfortable and helps ensure the best outcome each time. UC SHIP offers a range of benefits, including coverage for specialty office visits, prescriptions, diagnostic services, surgery, hospitalization and out-of-area care while traveling, to name a few.

The UC SHIP package also includes strong dental and vision benefits and covers most SHC fees. When you go to an appointment with your health care provider, they will ask you for your insurance information. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website. This information is important when you need to check your benefits or get other information.

For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website. Please note that you can enter information for multiple health plans. For services outside the SHC, UC SHIP contracts with Anthem Blue Cross to provide access to its extensive network of hospitals and providers, including UC Family facilities and provider groups. Each campus has an SHC, a complete outpatient health center for students, providing medical and preventive care, and mental health and substance use disorder services.

These facilities may be known by different names on each campus . SHC clinicians serve as your family doctor while you're at school. All registered students can use the SHC, regardless of what type of major medical insurance they have. A type of cost sharing where the patient and insurance company share payment of the approved charge for covered services after payment of the deductible by the patient. Anthem, the University's new health plan administrator, has sent new health insurance cards to the homes of eligible faculty and staff. The cards are enclosed in blue and white envelopes like this one.

Every health insurance card should have the patient's name on it. If you have insurance through someone else, such as a parent, you might see that person's name on the card instead. The card might also include other information, such as your home address, but this depends on the insurance company. Checking eligibility and benefits and/or obtaining benefit prior authorization/pre-notification or predetermination of benefits is not a guarantee that benefits will be paid.

Regardless of any benefit determination, the final decision regarding any treatment or service is between you and your patient. If you have any questions, please call the number on the member's ID card. Different insurance plans sometimes cover different pharmacy networks. For example, CDPHP employer plans use a Premier network; CDPHP individual plans use a Value network; and CDPHP plans for seniors use the Medicare network. UnitedHealth Group is an American for-profit managed health care company based in Minnetonka, Minnesota.

They offer a wide variety of health plans for individuals and businesses. The policies are usually popular in states where they're available, and the company has a large network of medical providers. Keep in mind that Anthem has a reputation for denying claims, and you may be able to avoid problems by carefully reviewing plan documents or contacting the insurance company before receiving care. The rate you pay for insurance will vary based on your personal details, where you live and the level of coverage you select. In 2022, individual health insurance plans are likely to be priced slightly higher, and the rate of increase varies by state.

You don't need authorization from the student health center for visits to an emergency room or urgent care clinic. Simply provide the facility with your Anthem member ID card. Claims provided to Anthem will be processed according to UC SHIP's benefits. For routine care, start at the student health center on your campus.

When you need medical care, call or visit your campus's SHC website to make an appointment. On most campuses, the SHC will file claims to UC SHIP, so you don't have to bother with the paperwork. A group of primary care physicians who have agreed to share the risk of providing medical care to their patients who are covered by a given health plan. An agreement by insurance company to pay for medical services. Physicians and hospitals ask the insurance company for this approval before providing medical services.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.